The highs and lows of the investment market

Herman er utdannet siviløkonom fra BI med etterutdannelse gjennom graduate programmet til A.P Møller-Maersk. Med mange års erfaring fra finans og shipping tok han i 2015 med seg sin erfaring fra disse markedene inn i Malling & Cos satsing på analyse av næringseiendom, hvor han har ansvaret for investeringsmarkedet. Herman brenner for å bruke analyser av investeringsmarkedet til å se attraktive muligheter og det beste beslutningsgrunnlaget for både kunder og eiendomshusets egne rådgivere.

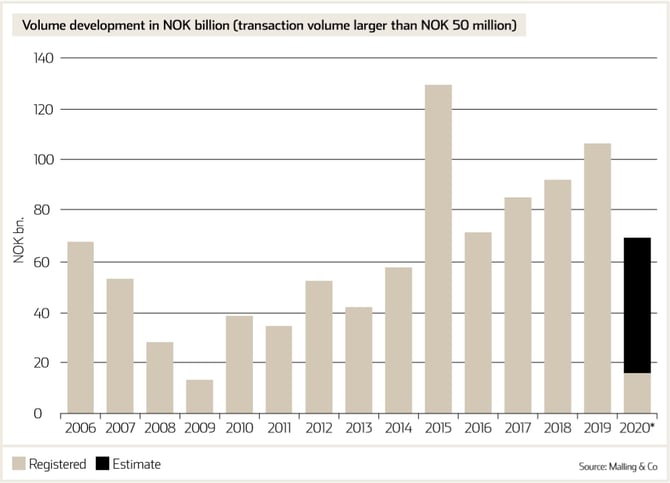

So far this year, we have registered a total transaction volume of NOK 17.8 billion, split between 67 transactions. With the Covid-19 outbreak, a very promising start to the investment market activity in 2020 came to a halt. But both from our survey and contact with investors, there is still high interest in commercial real estate as interest rates are coming down to record low levels. While most structured processes have been put on hold, there is still a steady flow of transactions done off-market. And to answer the big questions on everyone’s lips, prices have not moved significantly. While some uncertainty can be attributed to future rental prices, we have not seen any sign of anything but very modest discounts between 0 % and 5 % on pre-corona levels. Yet, with the underlying risk of the economy in general, and how the pandemic evolves going forward, we predict through our main scenario that Norwegian CRE will be firing back up in the second half of the year for a full year estimate of NOK 70 billion for 2020, a decrease of roughly 35 billion from 2019.

Banks are still there for their clients

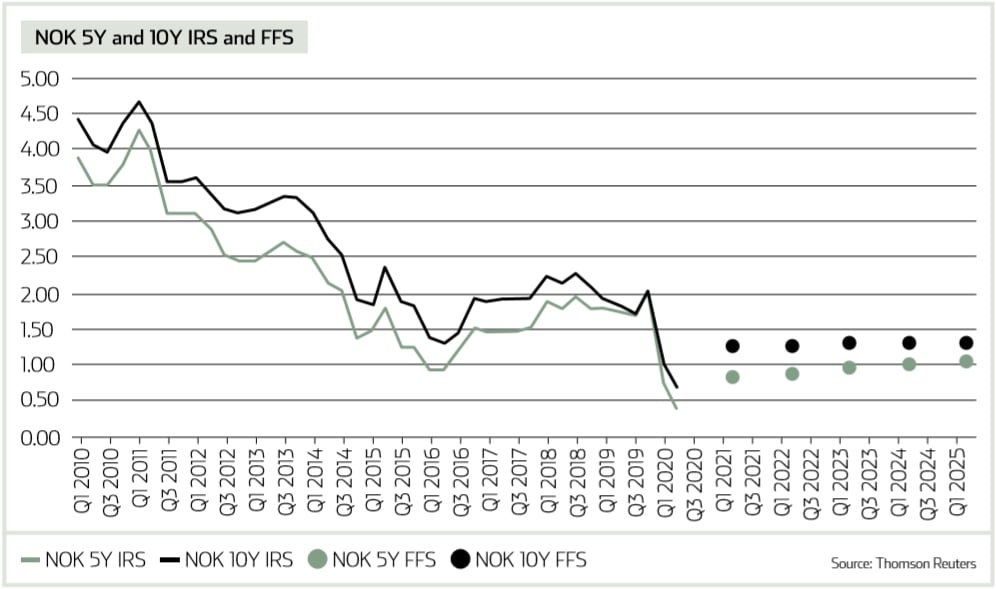

After the shock effect of society basically being shut down and interest rates going through the roof, central banks came to the aid of financial markets and we have since seen record low interest levels. And the low levels are expected to last for years to come, as the forward starting swaps as far out as 5 and 10 years are more or less flat too. After a brief halt while everyone was finding their footing, banks stepped up for their customers. Solid projects are still welcomed and supported. Although margins have been adjusted upwards, there is in sum still a lower total financing cost for many, as underlying interest rates have plummeted.

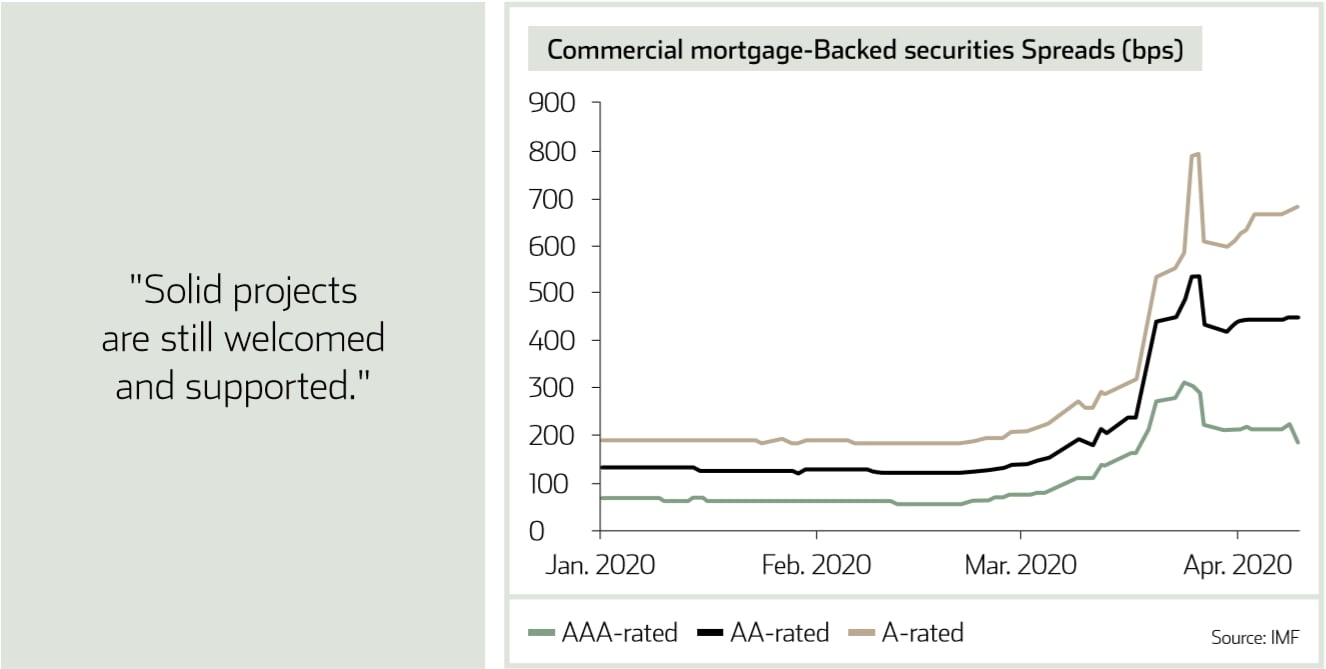

Bond financing is a different story now. Margins have increased substantially and are in most cases not competitive with bank financing. The big increase can be seen in our graph of CMBS spreads. And although they have come back down a little, the spreads factor is still 2-3 times higher than pre-Covid-19. Also worth noting is how prime AAA rating has come further back down of late, while AA-rating remains flat, and A rating is on an increasing trend again. Investors demand a premium for risk, and a flight to safety seems prevalent.

A safe harbour in turbulent times

Our regional overview for 2020 reveals that Oslo is a safe harbour in stormy weather, not only literally but also figuratively. Almost 60 % of the volume is from the Greater Oslo region. And though, admittedly, much of this volume is from pre Covid-19 lockdown, we are seeing more activity taking place in this region than that being reported from other major regions. Our main scenario is, however, still a gradual increase in activity across all regions towards summer, and a close to fully operational and functioning investment market over the summer. The second half should see the difference in volume share somewhat equalised towards a more normal share for the other regions outside of Greater Oslo. This is also supported by the Prime office yield levels across the regions, which have remained stable or decreased since our last report, and with our expectations that a shift is skewed towards a yield compression.

This is a section from our latest Market Report. Read more in-depth research and analysis into property market trends, forecasts from our specialist research teams here;

Motta rapporter og informasjon direkte i din e-post

Siste artikler

ARKIV

- februar 2026 (3)

- januar 2026 (5)

- desember 2025 (3)

- november 2025 (4)

- oktober 2025 (4)

- september 2025 (5)

- august 2025 (2)

- juli 2025 (3)

- juni 2025 (4)

- mai 2025 (2)

- april 2025 (6)

- mars 2025 (8)

- februar 2025 (5)

- januar 2025 (6)

- november 2024 (4)

- oktober 2024 (7)

- september 2024 (5)

- august 2024 (3)

- juli 2024 (3)

- juni 2024 (3)

- mai 2024 (4)

- april 2024 (3)

- mars 2024 (5)

- februar 2024 (5)

- januar 2024 (6)

- desember 2023 (3)

- november 2023 (6)

- oktober 2023 (5)

- september 2023 (1)

- august 2023 (4)

- juli 2023 (5)

- juni 2023 (4)

- mai 2023 (5)

- april 2023 (3)

- mars 2023 (3)

- februar 2023 (3)

- januar 2023 (5)

- desember 2022 (2)

- november 2022 (3)

- oktober 2022 (11)

- september 2022 (2)

- august 2022 (5)

- juli 2022 (4)

- juni 2022 (4)

- mai 2022 (1)

- april 2022 (5)

- mars 2022 (5)

- februar 2022 (3)

- januar 2022 (5)

- desember 2021 (2)

- november 2021 (5)

- oktober 2021 (3)

- september 2021 (3)

- august 2021 (2)

- juli 2021 (1)

- juni 2021 (8)

- mai 2021 (2)

- april 2021 (1)

- mars 2021 (5)

- februar 2021 (4)

- januar 2021 (7)

- desember 2020 (5)

- november 2020 (4)

- oktober 2020 (5)

- september 2020 (4)

- august 2020 (3)

- juli 2020 (4)

- juni 2020 (5)

- mai 2020 (5)

- april 2020 (4)

- mars 2020 (7)

- februar 2020 (3)

- januar 2020 (4)

- desember 2019 (4)

- november 2019 (4)

- oktober 2019 (4)

- september 2019 (4)

- august 2019 (4)

- juli 2019 (6)

- juni 2019 (6)

- mai 2019 (5)

- april 2019 (5)

- mars 2019 (3)

- februar 2019 (4)

- januar 2019 (6)

- november 2018 (6)

- oktober 2018 (4)

- september 2018 (5)

- august 2018 (1)

- juli 2018 (1)

- juni 2018 (4)

- mai 2018 (5)

- april 2018 (6)

- mars 2018 (1)

- februar 2018 (2)

- januar 2018 (4)

- desember 2017 (5)

- november 2017 (5)

- oktober 2017 (3)

- september 2017 (3)

- august 2017 (2)

- juli 2017 (1)

- juni 2017 (1)

- mai 2017 (6)

- april 2017 (5)

- mars 2017 (5)

- februar 2017 (2)

- januar 2017 (8)

- november 2016 (2)

- september 2016 (2)

- august 2016 (1)

- april 2016 (2)

- januar 2016 (1)

- november 2015 (2)

- september 2015 (2)

- august 2015 (1)

- juni 2015 (3)

- mai 2015 (1)

- april 2015 (1)

- mars 2015 (1)

- februar 2015 (2)

- januar 2015 (1)

- november 2014 (2)

- november 2013 (2)

- oktober 2013 (2)

- august 2013 (1)

- juli 2013 (1)

- juni 2013 (2)

- desember 2012 (1)

- november 2012 (1)

- september 2012 (1)

- juni 2012 (1)

- mai 2012 (1)

- desember 2011 (1)

- september 2011 (2)

- august 2011 (2)

- mars 2011 (1)

- desember 2010 (1)

- november 2010 (2)

- oktober 2010 (1)

- desember 2009 (1)

- november 2009 (1)

- mars 2009 (4)

- januar 2009 (1)

- desember 2008 (1)

- mai 2008 (1)

- desember 2007 (2)

- november 2007 (1)

- september 2007 (1)

- juli 2007 (1)

- mai 2007 (1)

- april 2007 (1)

- november 2006 (1)

- oktober 2006 (1)

- september 2006 (1)

- juni 2006 (1)

- april 2006 (1)

- februar 2006 (1)

- februar 2005 (1)