Supply and vacancy in Greater Oslo -Increased vacancy expected

Haakon er leder for analyse og verdivurdering i Malling & Co, og har jobbet i Malling med analyse av næringseiendom siden 2010. Han har en mastergrad innen Industriell økonomi og teknologiledelse fra NTNU i Trondheim, og har senere fullført en Executive MBA i finans ved NHH

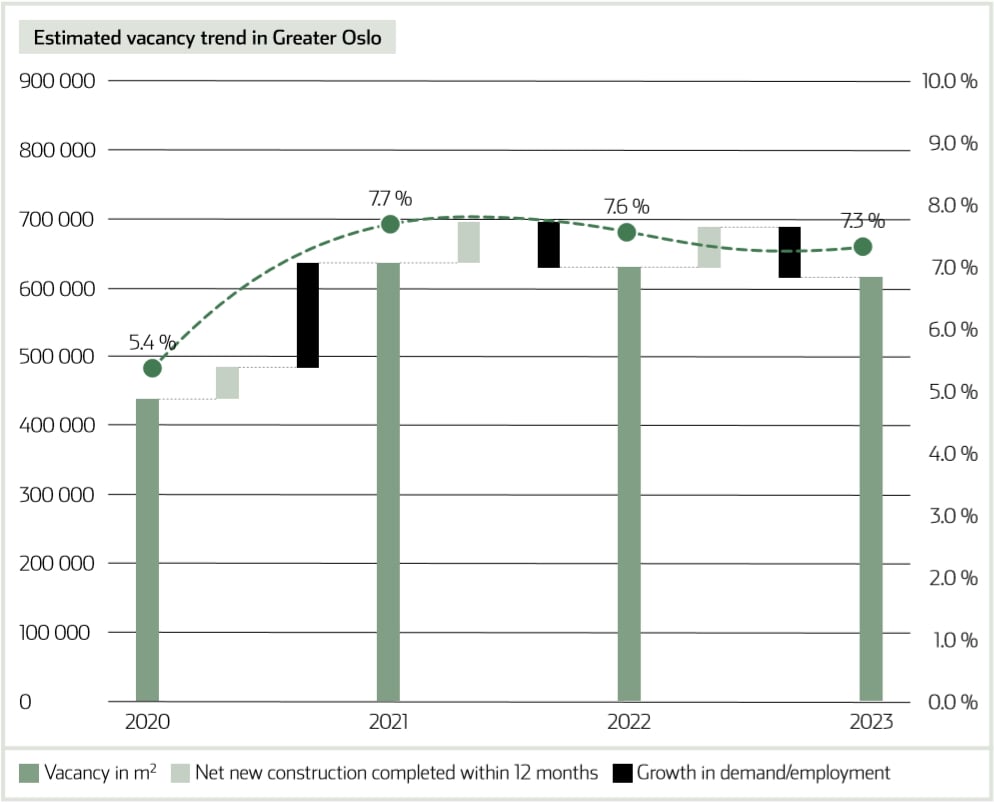

In our previous report we predicted slightly increasing vacancy in 2020, continuing into 2021. After nearly two years of record-low vacancy levels, increased construction and lower employment growth were expected to relieve some of the pressure off vacancy. As at April 2020, vacancy in our Greater Oslo office clusters was measured at 5.4 %. This is up 20 bps since October and 30 bps since April 2019, which is in line with our original forecast for 2020. There is, however, no need to point out that Covid-19 has completely changed market conditions, and that vacancy is likely to increase much more in 2020 compared to what was initially expected. Our current view is that vacancy should top out at around 7-8 % in 2021. However, the virus’ development and the resulting economic uncertainty makes the estimation of office vacancy much like shooting a moving target.

An update on vacancy in Greater Oslo

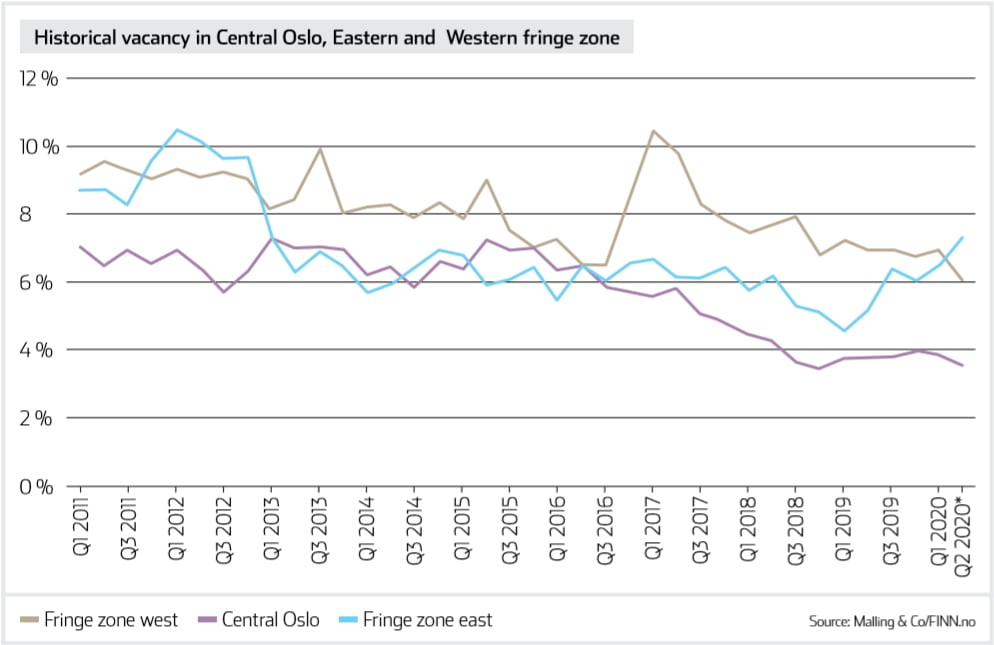

Vacancy in Greater Oslo was measured at 5.4 % in April 2020, which is an increase of around 20 bps since our last market report and in line with our pre-crisis forecast. Central Oslo has the lowest vacancy of 3.6 %, while the Western and Eastern fringe have vacancies of 6.1 % and 7.3 %, respectively. The Western and Eastern fringe zones have switched places vacancy-wise. Vacancy in the Eastern fringe has increased, mostly due to new constructions at Økern/Løren/Risløkka that are approaching completion. Many of the newbuilds are only partly let out which is now gradually being reflected in vacancy. As for the Western fringe, vacancy has come considerably down. This is mostly due to decreases in vacancy at Skøyen, where for example Drammensveien 144 has been taken off the market.

Expected development in the Greater Oslo subareas

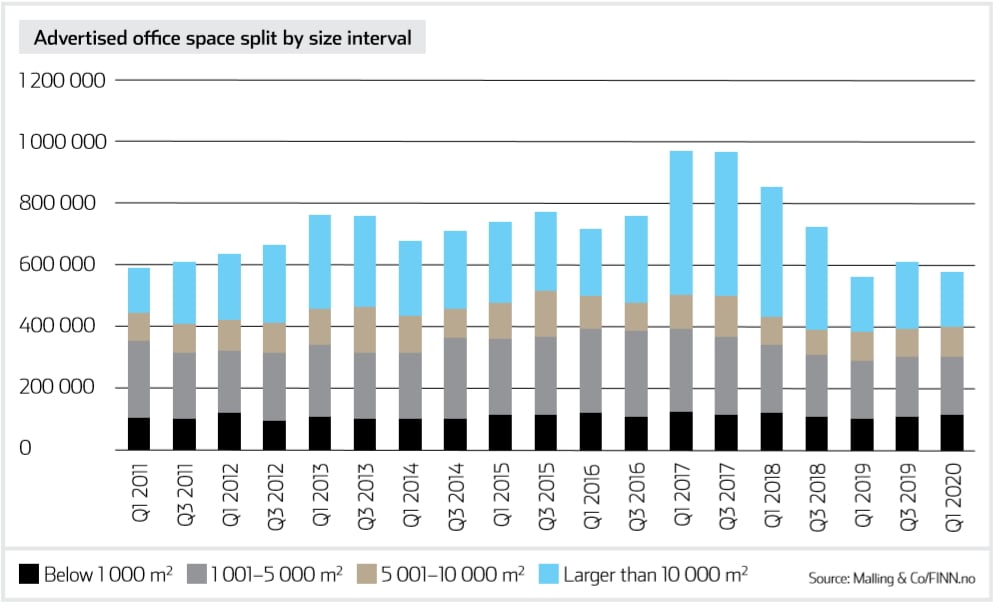

Although we expect all clusters to be affected eventually, some clusters will likely see higher increases in vacancy than others. Central Oslo has the advantage of coming from very low vacancy levels with an average of 3.6 % in April. The area is also generally more sought-after by tenants. The Inner City and Kvadraturen, however, have higher shares of exposed sectors within their tenant-base compared to other central clusters, which may result in higher vacancy-increases there. It is also worth noting that the Inner City’s supply is measured at 8.5 %, which is more than the double of its vacancy of 3.9 %. In addition, there are several refurbishments in Central Oslo, which increases supply of high-quality space, even if it does not involve new space. Some of this space will most likely eventually become a part of the vacancy, depending on whether the space is let out or not before approaching the 12-month limit, and on whether the projects will actually be built.

The Eastern fringe has the highest share of expected new construction, however many of these newbuilds have already been added to vacancy, which is currently measured at 7.3 %. Moreover, the tenant-base in the east is not necessarily weighted towards sectors at risk of bankruptcy. A large share of public tenants at Bryn/ Helsfyr and Nydalen/Sandaker may work as a partial cap on vacancy in the Eastern fringe. Vacancy in the Western fringe is currently measured at 6.1 %. After the oil price drop in 2014, subletting increased particularly in the Western fringe, where the oil sector in Oslo is located. Although the Western clusters’ tenant base is more dispersed now compared to then, we consider the Western fringe of being at higher risk and that some western clusters might see an increase in lease defaults and subletting over the coming months and years.

Vacancy in Greater Oslo going forward

As our expectations for new construction have been adjusted downwards considerably, the main determinant for vacancy going forward is the shut-down’s effect on demand through employment, as well as potential bankruptcies leading to an increase in contract defaults. Currently, office-related businesses are not directly affected, but over time an economic recession will affect these sectors as well. In short, we used historical employment figures to estimate the relative change in employment in Oslo given a change nationally. Multiplying this figure by the average size (m2) per employee, we estimate the expected change in underlying demand over the next three years. We then adjust this figure downwards in our vacancymodel, as we do not expect change in employment to have an immediate effect on available space, except in potential bankruptcy cases. This also applies the other way around, as increased employment does not result in an immediate increase in absorbed space, but rather in less space per employee.

Although net new construction is expected to be modest, the negative change in demand is expected to create an explosive growth in vacancy in the second half of 2020 and into 2021. We expect average office vacancy in Greater Oslo to increase by around 200-300 bps in 2020 and 2021, before stabilising in 2022.

This is a section from our latest Market Report. Read more in-depth research and analysis into property market trends, forecasts from our specialist research teams here;

Motta rapporter og informasjon direkte i din e-post

Siste artikler

ARKIV

- februar 2026 (3)

- januar 2026 (5)

- desember 2025 (3)

- november 2025 (4)

- oktober 2025 (4)

- september 2025 (5)

- august 2025 (2)

- juli 2025 (3)

- juni 2025 (4)

- mai 2025 (2)

- april 2025 (6)

- mars 2025 (8)

- februar 2025 (5)

- januar 2025 (6)

- november 2024 (4)

- oktober 2024 (7)

- september 2024 (5)

- august 2024 (3)

- juli 2024 (3)

- juni 2024 (3)

- mai 2024 (4)

- april 2024 (3)

- mars 2024 (5)

- februar 2024 (5)

- januar 2024 (6)

- desember 2023 (3)

- november 2023 (6)

- oktober 2023 (5)

- september 2023 (1)

- august 2023 (4)

- juli 2023 (5)

- juni 2023 (4)

- mai 2023 (5)

- april 2023 (3)

- mars 2023 (3)

- februar 2023 (3)

- januar 2023 (5)

- desember 2022 (2)

- november 2022 (3)

- oktober 2022 (11)

- september 2022 (2)

- august 2022 (5)

- juli 2022 (4)

- juni 2022 (4)

- mai 2022 (1)

- april 2022 (5)

- mars 2022 (5)

- februar 2022 (3)

- januar 2022 (5)

- desember 2021 (2)

- november 2021 (5)

- oktober 2021 (3)

- september 2021 (3)

- august 2021 (2)

- juli 2021 (1)

- juni 2021 (8)

- mai 2021 (2)

- april 2021 (1)

- mars 2021 (5)

- februar 2021 (4)

- januar 2021 (7)

- desember 2020 (5)

- november 2020 (4)

- oktober 2020 (5)

- september 2020 (4)

- august 2020 (3)

- juli 2020 (4)

- juni 2020 (5)

- mai 2020 (5)

- april 2020 (4)

- mars 2020 (7)

- februar 2020 (3)

- januar 2020 (4)

- desember 2019 (4)

- november 2019 (4)

- oktober 2019 (4)

- september 2019 (4)

- august 2019 (4)

- juli 2019 (6)

- juni 2019 (6)

- mai 2019 (5)

- april 2019 (5)

- mars 2019 (3)

- februar 2019 (4)

- januar 2019 (6)

- november 2018 (6)

- oktober 2018 (4)

- september 2018 (5)

- august 2018 (1)

- juli 2018 (1)

- juni 2018 (4)

- mai 2018 (5)

- april 2018 (6)

- mars 2018 (1)

- februar 2018 (2)

- januar 2018 (4)

- desember 2017 (5)

- november 2017 (5)

- oktober 2017 (3)

- september 2017 (3)

- august 2017 (2)

- juli 2017 (1)

- juni 2017 (1)

- mai 2017 (6)

- april 2017 (5)

- mars 2017 (5)

- februar 2017 (2)

- januar 2017 (8)

- november 2016 (2)

- september 2016 (2)

- august 2016 (1)

- april 2016 (2)

- januar 2016 (1)

- november 2015 (2)

- september 2015 (2)

- august 2015 (1)

- juni 2015 (3)

- mai 2015 (1)

- april 2015 (1)

- mars 2015 (1)

- februar 2015 (2)

- januar 2015 (1)

- november 2014 (2)

- november 2013 (2)

- oktober 2013 (2)

- august 2013 (1)

- juli 2013 (1)

- juni 2013 (2)

- desember 2012 (1)

- november 2012 (1)

- september 2012 (1)

- juni 2012 (1)

- mai 2012 (1)

- desember 2011 (1)

- september 2011 (2)

- august 2011 (2)

- mars 2011 (1)

- desember 2010 (1)

- november 2010 (2)

- oktober 2010 (1)

- desember 2009 (1)

- november 2009 (1)

- mars 2009 (4)

- januar 2009 (1)

- desember 2008 (1)

- mai 2008 (1)

- desember 2007 (2)

- november 2007 (1)

- september 2007 (1)

- juli 2007 (1)

- mai 2007 (1)

- april 2007 (1)

- november 2006 (1)

- oktober 2006 (1)

- september 2006 (1)

- juni 2006 (1)

- april 2006 (1)

- februar 2006 (1)

- februar 2005 (1)