NORDICS DOMINATE DATA CENTRE INVESTMENT BUT PRIVACY & SOVEREIGNTY ISSUES SET TO DRIVE DEMAND ACROSS EUROPE

Marianne har jobbet som markedssjef i Malling & Co siden 2010. Hun er glødende opptatt av merkevarebygging basert på samspillet mellom markedsføring, CRM og ny teknologi. Marianne har over 25 års erfaring med markedsføring av næringseiendom men er utdannet profesjonell dykker og er verdens første kvinnelige metningsdykker. Når hun ikke tenker på markedsføring, er hun engasjert i byutvikling, ny teknologi og kultur.

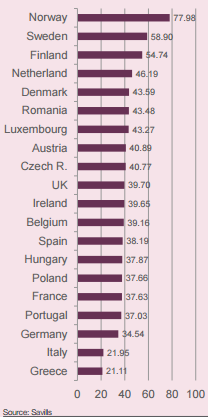

The Nordics and the Netherlands offer the best opportunities for investment in the surging data centres market, according to Savills new Data Centre Investment Index, but the need to have smaller scale domestic facilities to comply with data and privacy laws is set to lead to an uptick in activity across all of Europe.

€450 million was invested in European datacentres in 2017, with the UK accounting for 41% of all deals between 2007 and 2017, says Savills, but investment activity is beginning to pick up across continental Europe as investors become more familiar with the sector.

According to Savills, owing to the growing popularity of cloud-based infrastructures, the need for cost-effective hyper-scale data centres of 50,000+ sq m in Europe has grown exponentially over the past five years, with Cisco predicting that hyper-scale data centre traffic will quintuple over the next five. Savills has therefore identified the best locations in Europe in which to invest, benchmarking 20 countries against 12 indicators crucial to the development of datacentres*. The Nordic nations take four of the top five slots, given their strengths in offering low energy costs, cool weather and access to water, with the Netherlands rounding out the top five.

Marcus Lemli, head of European investment, Savills, comments: “With data centre occupiers taking leases of 10 years or more, and an increasing number looking towards sale and leaseback options, the sector offers investors an appealing proposition. Data Centres are increasingly an investment product category accepted by institutional investors such as AXA and CBRE Global Investors, and the weight of money has pushed yields down significantly over the last couple of years to 5-7%. We expect these yields to move in further in the coming months and years.”

|

Datacentre investment REITs are the most active buyers in the sector, notably US Equinix REIT, the Asian Keppel DC REIT and the US Digital Realty, says Savills, but as the market grows it is slowly opening to non-specialist investors (investment managers and general REITs). Lydia Brissy, European research director, says: “New datacentres are increasingly concentrating in suburban or rural areas in countries that offer the best opportunities in terms of natural environment, security, energy and connectivity, with the Nordics being the location of choice for hyper-scale facilities. But there’s still a need for small and medium-sized centres, nationally based, to mitigate any potential latency and also to avoid legal issues relating to data sovereignty. This means that countries such as the UK, Germany France and the Netherlands will continue to witness an increasing demand for data storage and corresponding investor activity.” |

*The Savills Data Centre Investment Index benchmarks 20 countries against 12 indicators crucial to the development of datacentres: average annual temperature; the average temperature during the peak month of the year; the availability of fresh water per capita; the average annual loss liaised to natural disasters; political instability; cybersecurity; the electricity production per capita; electricity price; the availability of green energy per capita; the internet average speed and the FTTH/B (fibre to home / fibre to building) penetration rate. The various indicators have been graded and ranked across the 20 countries.

For further information, please contact:

Marcus Lemli, Savills European investment Tel: +49 69 273 000 11

Lydia Brissy, Savills research Tel: +33 624 623 644

Natalie Moorse, Savills press office Tel: +44 (0) 20 7075 2827

Motta rapporter og informasjon direkte i din e-post

Siste artikler

ARKIV

- februar 2026 (3)

- januar 2026 (5)

- desember 2025 (3)

- november 2025 (4)

- oktober 2025 (4)

- september 2025 (5)

- august 2025 (2)

- juli 2025 (3)

- juni 2025 (4)

- mai 2025 (2)

- april 2025 (6)

- mars 2025 (8)

- februar 2025 (5)

- januar 2025 (6)

- november 2024 (4)

- oktober 2024 (7)

- september 2024 (5)

- august 2024 (3)

- juli 2024 (3)

- juni 2024 (3)

- mai 2024 (4)

- april 2024 (3)

- mars 2024 (5)

- februar 2024 (5)

- januar 2024 (6)

- desember 2023 (3)

- november 2023 (6)

- oktober 2023 (5)

- september 2023 (1)

- august 2023 (4)

- juli 2023 (5)

- juni 2023 (4)

- mai 2023 (5)

- april 2023 (3)

- mars 2023 (3)

- februar 2023 (3)

- januar 2023 (5)

- desember 2022 (2)

- november 2022 (3)

- oktober 2022 (11)

- september 2022 (2)

- august 2022 (5)

- juli 2022 (4)

- juni 2022 (4)

- mai 2022 (1)

- april 2022 (5)

- mars 2022 (5)

- februar 2022 (3)

- januar 2022 (5)

- desember 2021 (2)

- november 2021 (5)

- oktober 2021 (3)

- september 2021 (3)

- august 2021 (2)

- juli 2021 (1)

- juni 2021 (8)

- mai 2021 (2)

- april 2021 (1)

- mars 2021 (5)

- februar 2021 (4)

- januar 2021 (7)

- desember 2020 (5)

- november 2020 (4)

- oktober 2020 (5)

- september 2020 (4)

- august 2020 (3)

- juli 2020 (4)

- juni 2020 (5)

- mai 2020 (5)

- april 2020 (4)

- mars 2020 (7)

- februar 2020 (3)

- januar 2020 (4)

- desember 2019 (4)

- november 2019 (4)

- oktober 2019 (4)

- september 2019 (4)

- august 2019 (4)

- juli 2019 (6)

- juni 2019 (6)

- mai 2019 (5)

- april 2019 (5)

- mars 2019 (3)

- februar 2019 (4)

- januar 2019 (6)

- november 2018 (6)

- oktober 2018 (4)

- september 2018 (5)

- august 2018 (1)

- juli 2018 (1)

- juni 2018 (4)

- mai 2018 (5)

- april 2018 (6)

- mars 2018 (1)

- februar 2018 (2)

- januar 2018 (4)

- desember 2017 (5)

- november 2017 (5)

- oktober 2017 (3)

- september 2017 (3)

- august 2017 (2)

- juli 2017 (1)

- juni 2017 (1)

- mai 2017 (6)

- april 2017 (5)

- mars 2017 (5)

- februar 2017 (2)

- januar 2017 (8)

- november 2016 (2)

- september 2016 (2)

- august 2016 (1)

- april 2016 (2)

- januar 2016 (1)

- november 2015 (2)

- september 2015 (2)

- august 2015 (1)

- juni 2015 (3)

- mai 2015 (1)

- april 2015 (1)

- mars 2015 (1)

- februar 2015 (2)

- januar 2015 (1)

- november 2014 (2)

- november 2013 (2)

- oktober 2013 (2)

- august 2013 (1)

- juli 2013 (1)

- juni 2013 (2)

- desember 2012 (1)

- november 2012 (1)

- september 2012 (1)

- juni 2012 (1)

- mai 2012 (1)

- desember 2011 (1)

- september 2011 (2)

- august 2011 (2)

- mars 2011 (1)

- desember 2010 (1)

- november 2010 (2)

- oktober 2010 (1)

- desember 2009 (1)

- november 2009 (1)

- mars 2009 (4)

- januar 2009 (1)

- desember 2008 (1)

- mai 2008 (1)

- desember 2007 (2)

- november 2007 (1)

- september 2007 (1)

- juli 2007 (1)

- mai 2007 (1)

- april 2007 (1)

- november 2006 (1)

- oktober 2006 (1)

- september 2006 (1)

- juni 2006 (1)

- april 2006 (1)

- februar 2006 (1)

- februar 2005 (1)