EUROPE’S ‘SECOND CITIES’ EXPECTED TO BE HOTSPOTS FOR FUTURE FLEXIBLE OFFICE DEMAND

Marianne har jobbet som markedssjef i Malling & Co siden 2010. Hun er glødende opptatt av merkevarebygging basert på samspillet mellom markedsføring, CRM og ny teknologi. Marianne har over 25 års erfaring med markedsføring av næringseiendom men er utdannet profesjonell dykker og er verdens første kvinnelige metningsdykker. Når hun ikke tenker på markedsføring, er hun engasjert i byutvikling, ny teknologi og kultur.

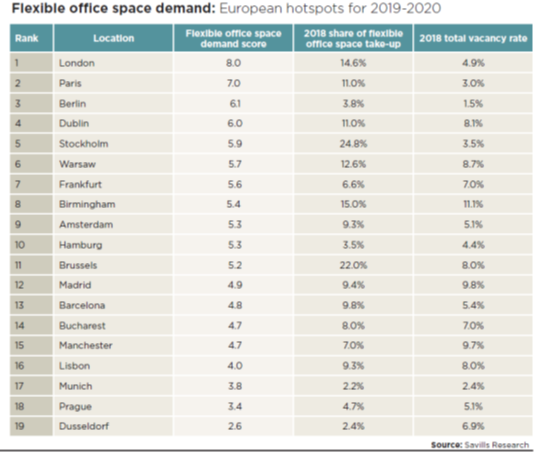

Strong demand expected in Dublin, Stockholm, Warsaw, Madrid, Barcelona, Bucharest and Lisbon. Future demand also to be high in non-capital cities such as Hamburg, Frankfurt and Birmingham.According to the latest research from Savills and Workthere, smaller capital cities across Europe such as Dublin, Stockholm, Warsaw and ‘non-capital cities’ in core countries such as Hamburg, Frankfurt and Birmingham are likely to see strong demand for flexible office market.

The European Flexible Office Spotlight reports that, while core European capitals including London and Paris, which have more mature serviced office markets, will see higher demand for flexible office space (FOS), other cities that also have a dynamic economies and attract innovation and talent will see demand for flexible offices rise.

Eri Mitsostergiou, research director at Savills, says:

“As part of our research, we have identified the cities where we expect future demand to be strongest based on a set of criteria related to economic growth, job creation, innovation, and property market fundamentals. It is no surprise that London, Paris and Berlin are at the top of the ranking, as they attract 80% of the Venture Capital (VC) investment of the cities we analyse. However, what is interesting is that capitals outside of the three core countries (France, UK and Germany) such as Amsterdam, Brussels, Dublin, Stockholm and Warsaw as well as Germany’s second largest city Hamburg and financial centre Frankfurt all rank in the top ten.”

“As part of our research, we have identified the cities where we expect future demand to be strongest based on a set of criteria related to economic growth, job creation, innovation, and property market fundamentals. It is no surprise that London, Paris and Berlin are at the top of the ranking, as they attract 80% of the Venture Capital (VC) investment of the cities we analyse. However, what is interesting is that capitals outside of the three core countries (France, UK and Germany) such as Amsterdam, Brussels, Dublin, Stockholm and Warsaw as well as Germany’s second largest city Hamburg and financial centre Frankfurt all rank in the top ten.”

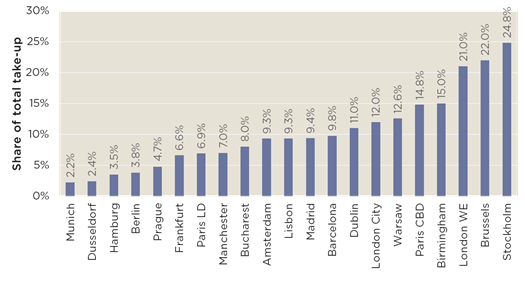

The research notes that a quarter (24.8%) of office take up in Stockholm and a fifth of office take up in Brussels (22%) and London’s West End (21%) is now flexible office space. This is followed by Paris CBD (14.8%), Warsaw (12.9%), London City (12%) and Dublin (11%).

Eri continues: “Last year flexible office space take-up increased by 20% year on year to reach almost 830,000 sq m across the 20 major European cities that we monitor. This corresponds to 9.9% of the total take-up levels, when only three years ago this share was below 3%. As take-up of flexible offices continues to grow, it’s the smaller, ‘second cities’ where availability is higher and therefore where we can expect to see most growth.”

Haakon Ødegaard, Leader of Malling & Co Research and Valuation comments:

"Many of the trends observed on flexible office space (FOS) in Europe are observed in the Norwegian market as well. FOS has been a popular and highly debated subject over the past year, and Norwegian players are now starting to offer flexible solutions in addition to the traditional office lease structure. Oslo possesses many of the same drivers that facilitate growth in demand for FOS. For example, the VC investment volume has recovered since the financial crisis and the number of micro enterprises and SMEs has grown by 4% and 19% respectively since 2009. Nevertheless, the service is more developed and segmented in the larger European cities. For example, there are co-working spaces in London targeting only new parents by offering nursery services for the children of the workers. The general opinion of FOS in Norway is split, and many are questioning the sustainability of the sectors speedy growth. In order to make a high-quality assessment of the potential and value of this sector, transparency is necessary. Access to data on factors such as user demand, turnover and occupancy is imperative. Moreover, better insight into bigger corporations’ interest in flexible solutions is also a potentially important determinant. Although the great interest for FOS is fairly new in Oslo, it has proven to be a quickly growing sector, that will without question have a big impact on the Norwegian office market."

"Many of the trends observed on flexible office space (FOS) in Europe are observed in the Norwegian market as well. FOS has been a popular and highly debated subject over the past year, and Norwegian players are now starting to offer flexible solutions in addition to the traditional office lease structure. Oslo possesses many of the same drivers that facilitate growth in demand for FOS. For example, the VC investment volume has recovered since the financial crisis and the number of micro enterprises and SMEs has grown by 4% and 19% respectively since 2009. Nevertheless, the service is more developed and segmented in the larger European cities. For example, there are co-working spaces in London targeting only new parents by offering nursery services for the children of the workers. The general opinion of FOS in Norway is split, and many are questioning the sustainability of the sectors speedy growth. In order to make a high-quality assessment of the potential and value of this sector, transparency is necessary. Access to data on factors such as user demand, turnover and occupancy is imperative. Moreover, better insight into bigger corporations’ interest in flexible solutions is also a potentially important determinant. Although the great interest for FOS is fairly new in Oslo, it has proven to be a quickly growing sector, that will without question have a big impact on the Norwegian office market."

Cal Lee, global head and founder of Workthere, comments:

“Looking forward, we expect the popularity of the flexible offices sector to intensify as the sector diversifies its offer. We believe that cities with dynamic economies, which attract innovation and talent can see demand for flexible offices rise up to 15% of the total in the medium term, while in the long term this could increase to 20-25%, especially in periods of economic growth and business investment.

“Over the next two years we expect to see the highest expansion of flexible offices in smaller but dynamic markets where availability allows and the share of flexible office space take-up is still below 15%, such as Dublin, Madrid, Barcelona, Bucharest and Lisbon.”

Listen to Real estate insights podcast: Europe’s next hotspots for flexible offices

Motta rapporter og informasjon direkte i din e-post

Siste artikler

ARKIV

- februar 2026 (3)

- januar 2026 (5)

- desember 2025 (3)

- november 2025 (4)

- oktober 2025 (4)

- september 2025 (5)

- august 2025 (2)

- juli 2025 (3)

- juni 2025 (4)

- mai 2025 (2)

- april 2025 (6)

- mars 2025 (8)

- februar 2025 (5)

- januar 2025 (6)

- november 2024 (4)

- oktober 2024 (7)

- september 2024 (5)

- august 2024 (3)

- juli 2024 (3)

- juni 2024 (3)

- mai 2024 (4)

- april 2024 (3)

- mars 2024 (5)

- februar 2024 (5)

- januar 2024 (6)

- desember 2023 (3)

- november 2023 (6)

- oktober 2023 (5)

- september 2023 (1)

- august 2023 (4)

- juli 2023 (5)

- juni 2023 (4)

- mai 2023 (5)

- april 2023 (3)

- mars 2023 (3)

- februar 2023 (3)

- januar 2023 (5)

- desember 2022 (2)

- november 2022 (3)

- oktober 2022 (11)

- september 2022 (2)

- august 2022 (5)

- juli 2022 (4)

- juni 2022 (4)

- mai 2022 (1)

- april 2022 (5)

- mars 2022 (5)

- februar 2022 (3)

- januar 2022 (5)

- desember 2021 (2)

- november 2021 (5)

- oktober 2021 (3)

- september 2021 (3)

- august 2021 (2)

- juli 2021 (1)

- juni 2021 (8)

- mai 2021 (2)

- april 2021 (1)

- mars 2021 (5)

- februar 2021 (4)

- januar 2021 (7)

- desember 2020 (5)

- november 2020 (4)

- oktober 2020 (5)

- september 2020 (4)

- august 2020 (3)

- juli 2020 (4)

- juni 2020 (5)

- mai 2020 (5)

- april 2020 (4)

- mars 2020 (7)

- februar 2020 (3)

- januar 2020 (4)

- desember 2019 (4)

- november 2019 (4)

- oktober 2019 (4)

- september 2019 (4)

- august 2019 (4)

- juli 2019 (6)

- juni 2019 (6)

- mai 2019 (5)

- april 2019 (5)

- mars 2019 (3)

- februar 2019 (4)

- januar 2019 (6)

- november 2018 (6)

- oktober 2018 (4)

- september 2018 (5)

- august 2018 (1)

- juli 2018 (1)

- juni 2018 (4)

- mai 2018 (5)

- april 2018 (6)

- mars 2018 (1)

- februar 2018 (2)

- januar 2018 (4)

- desember 2017 (5)

- november 2017 (5)

- oktober 2017 (3)

- september 2017 (3)

- august 2017 (2)

- juli 2017 (1)

- juni 2017 (1)

- mai 2017 (6)

- april 2017 (5)

- mars 2017 (5)

- februar 2017 (2)

- januar 2017 (8)

- november 2016 (2)

- september 2016 (2)

- august 2016 (1)

- april 2016 (2)

- januar 2016 (1)

- november 2015 (2)

- september 2015 (2)

- august 2015 (1)

- juni 2015 (3)

- mai 2015 (1)

- april 2015 (1)

- mars 2015 (1)

- februar 2015 (2)

- januar 2015 (1)

- november 2014 (2)

- november 2013 (2)

- oktober 2013 (2)

- august 2013 (1)

- juli 2013 (1)

- juni 2013 (2)

- desember 2012 (1)

- november 2012 (1)

- september 2012 (1)

- juni 2012 (1)

- mai 2012 (1)

- desember 2011 (1)

- september 2011 (2)

- august 2011 (2)

- mars 2011 (1)

- desember 2010 (1)

- november 2010 (2)

- oktober 2010 (1)

- desember 2009 (1)

- november 2009 (1)

- mars 2009 (4)

- januar 2009 (1)

- desember 2008 (1)

- mai 2008 (1)

- desember 2007 (2)

- november 2007 (1)

- september 2007 (1)

- juli 2007 (1)

- mai 2007 (1)

- april 2007 (1)

- november 2006 (1)

- oktober 2006 (1)

- september 2006 (1)

- juni 2006 (1)

- april 2006 (1)

- februar 2006 (1)

- februar 2005 (1)