BUSINESS UNCERTAINTY DRIVING EUROPEAN OCCUPIERS TO FRINGE LOCATIONS, FLEXIBLE OFFICES AND DEVELOPMENT OPPORTUNITIES

Marianne har jobbet som markedssjef i Malling & Co siden 2010. Hun er glødende opptatt av merkevarebygging basert på samspillet mellom markedsføring, CRM og ny teknologi. Marianne har over 25 års erfaring med markedsføring av næringseiendom men er utdannet profesjonell dykker og er verdens første kvinnelige metningsdykker. Når hun ikke tenker på markedsføring, er hun engasjert i byutvikling, ny teknologi og kultur.

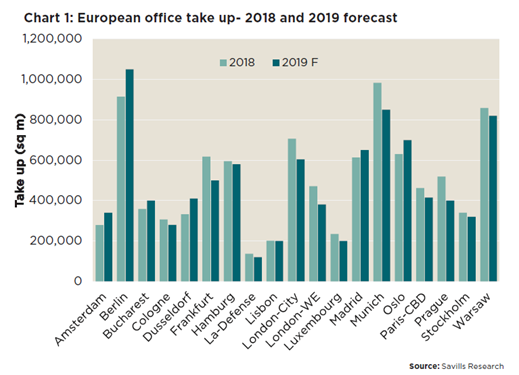

European office take up is forecast to reach 9.2 million sq m by the end of 2019, down marginally by 4% from 2018’s end year volume of 9.6 million sq m, according to Savills latest research. A shortage of good quality, available space across Europe’s CBDs is limiting occupiers’ choices as average vacancy rates dropped from 6.1% to 5.4% over the past 12 months.

Jeremy Bates, EMEA head of occupational markets at Savills, says: “As the European economy edges nearer to full capacity, job growth will remain positive, but more modest than in recent years. The strongest growth will come from the knowledge-led sectors, including professional services, science and high-tech. The occupational story remains resilient, though European occupiers will be more cost-conscious as productivity moderates, and will therefore look to adopt new workplace strategies to boost output and control costs.”

The shortage of available space is pushing new office demand out to fringe markets, where opportunistic investors are pursuing opportunities to refurbish, re-let and sell on. It is also driving increasing demand for flexible office space across Europe.

Mike Barnes, associate, European research, Savills, says: “The combination of good underlying demand and low vacancy rates has applied accelerated rental growth in 2019. Indeed, prime CBD office rents have risen 6.2% on average over the past 12 months, up from 4.0% over the previous 12 months.

“Looking ahead into 2020, prime office rents are forecast to grow by an average of 2% across the surveyed cities, with among the strongest levels of rental growth in Stockholm (6%), Amsterdam (6%) and Luxembourg (6%). We still expect upward rental growth across the majority of the German cities, though at a lower rate than we have witnessed in 2019 due to a slowdown in the German economy and forecast reduction in demand and take-up. The majority of cities will be experiencing growth of around 1% given a lack of new speculative product coming to the market.”

2019 has so far been another boom year for flexible offices across Europe. 687,000 sq m of space has been signed for by flexible office operators between Q1 and Q3 2019, 15% above the equivalent level over the same period in 2018.

Jessica Alderson, global research analyst at Workthere, Savills flexible office specialist, states: “New, niche operators are entering the market, reducing the operating profit margins on offer for the more established players as landlords weigh up opportunities to launch their own co-working space to increase income streams. Examples include The Office Operators (TOO) signing in Almere, the Netherlands, during Q1 2019 and French company, Wojo, setting up business in Barcelona, where they will occupy 8,000 sq m of a newly-developed office building in 22@. In 2018, flexible office take up accounted for 10.2% of Europe’s office take up, which has risen to 12% of total take up in Q1-Q3 2019.”

According to Workthere, across Europe, the average number of desks required within a flexible workspace increased by 7% in the first nine months of the year to 12.5 desks as the landscape further shifted from individual freelancers looking for coworking memberships to dedicated private offices for companies. The biggest differentials between the capital and regional city desk prices are in France and the UK.

In France, the €700 monthly desk prices in Paris are roughly double that of Lyon, Marseille and Nice. In the UK, the £700 (€819) monthly desk prices in London are also approximately double that of the regional cities such as Manchester, Birmingham, Leeds and Reading. There is also a noticeable differential in The Netherlands, with the average desk prices in Amsterdam being 54-67% higher than The Hague, Eindhoven, Rotterdam and Utrecht. Germany, Ireland and Spain have slightly more homogenous prices between the major cities, with differentials of broadly 20-30%.

Jeremy Bates adds: “Flexible offices will continue to grow as ‘space-as-a-service’ becomes more mainstream across European markets and we expect to exceed 13% of total office demand in 2020, although we do expect to see more landlords creating their own operational offering. Those cities with higher tech occupier bases should see the strongest increases in flex space demand as startups seek space on a per-desk basis. Naturally, the more traditional lease will work more effectively for corporate occupiers who are planning their real estate decisions on longer time frames.”

Read the full report: European Office outlook

Motta rapporter og informasjon direkte i din e-post

Siste artikler

ARKIV

- mars 2026 (2)

- februar 2026 (4)

- januar 2026 (5)

- desember 2025 (3)

- november 2025 (4)

- oktober 2025 (4)

- september 2025 (5)

- august 2025 (2)

- juli 2025 (3)

- juni 2025 (4)

- mai 2025 (2)

- april 2025 (6)

- mars 2025 (8)

- februar 2025 (5)

- januar 2025 (6)

- november 2024 (4)

- oktober 2024 (7)

- september 2024 (5)

- august 2024 (3)

- juli 2024 (3)

- juni 2024 (3)

- mai 2024 (4)

- april 2024 (3)

- mars 2024 (5)

- februar 2024 (5)

- januar 2024 (6)

- desember 2023 (3)

- november 2023 (6)

- oktober 2023 (5)

- september 2023 (1)

- august 2023 (4)

- juli 2023 (5)

- juni 2023 (4)

- mai 2023 (5)

- april 2023 (3)

- mars 2023 (3)

- februar 2023 (3)

- januar 2023 (5)

- desember 2022 (2)

- november 2022 (3)

- oktober 2022 (11)

- september 2022 (2)

- august 2022 (5)

- juli 2022 (4)

- juni 2022 (4)

- mai 2022 (1)

- april 2022 (5)

- mars 2022 (5)

- februar 2022 (3)

- januar 2022 (5)

- desember 2021 (2)

- november 2021 (5)

- oktober 2021 (3)

- september 2021 (3)

- august 2021 (2)

- juli 2021 (1)

- juni 2021 (8)

- mai 2021 (2)

- april 2021 (1)

- mars 2021 (5)

- februar 2021 (4)

- januar 2021 (7)

- desember 2020 (5)

- november 2020 (4)

- oktober 2020 (5)

- september 2020 (4)

- august 2020 (3)

- juli 2020 (4)

- juni 2020 (5)

- mai 2020 (5)

- april 2020 (4)

- mars 2020 (7)

- februar 2020 (3)

- januar 2020 (4)

- desember 2019 (4)

- november 2019 (4)

- oktober 2019 (4)

- september 2019 (4)

- august 2019 (4)

- juli 2019 (6)

- juni 2019 (6)

- mai 2019 (5)

- april 2019 (5)

- mars 2019 (3)

- februar 2019 (4)

- januar 2019 (6)

- november 2018 (6)

- oktober 2018 (4)

- september 2018 (5)

- august 2018 (1)

- juli 2018 (1)

- juni 2018 (4)

- mai 2018 (5)

- april 2018 (6)

- mars 2018 (1)

- februar 2018 (2)

- januar 2018 (4)

- desember 2017 (5)

- november 2017 (5)

- oktober 2017 (3)

- september 2017 (3)

- august 2017 (2)

- juli 2017 (1)

- juni 2017 (1)

- mai 2017 (6)

- april 2017 (5)

- mars 2017 (5)

- februar 2017 (2)

- januar 2017 (8)

- november 2016 (2)

- september 2016 (2)

- august 2016 (1)

- april 2016 (2)

- januar 2016 (1)

- november 2015 (2)

- september 2015 (2)

- august 2015 (1)

- juni 2015 (3)

- mai 2015 (1)

- april 2015 (1)

- mars 2015 (1)

- februar 2015 (2)

- januar 2015 (1)

- november 2014 (2)

- november 2013 (2)

- oktober 2013 (2)

- august 2013 (1)

- juli 2013 (1)

- juni 2013 (2)

- desember 2012 (1)

- november 2012 (1)

- september 2012 (1)

- juni 2012 (1)

- mai 2012 (1)

- desember 2011 (1)

- september 2011 (2)

- august 2011 (2)

- mars 2011 (1)

- desember 2010 (1)

- november 2010 (2)

- oktober 2010 (1)

- desember 2009 (1)

- november 2009 (1)

- mars 2009 (4)

- januar 2009 (1)

- desember 2008 (1)

- mai 2008 (1)

- desember 2007 (2)

- november 2007 (1)

- september 2007 (1)

- juli 2007 (1)

- mai 2007 (1)

- april 2007 (1)

- november 2006 (1)

- oktober 2006 (1)

- september 2006 (1)

- juni 2006 (1)

- april 2006 (1)

- februar 2006 (1)

- februar 2005 (1)